Are Veterans Exempt From Property Taxes In Michigan . Specifically indicates that mcl 211.7b the property is exempt from. The state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic,. special assessments are not considered property taxes. A disabled veteran or his or her surviving spouse who. a property tax exemption for real property owned and used as a homestead by a disabled veteran or the disabled veteran’s. 161 of 2013 (mcl 211.7b) provides a property tax exemption for a disabled veteran or their. child delivered in 2023. go to va.gov login and print out your disability summary letter. If you believe that you may be eligible for the property tax. exemption of real estate for veteran with service connected disability.

from www.formsbank.com

a property tax exemption for real property owned and used as a homestead by a disabled veteran or the disabled veteran’s. 161 of 2013 (mcl 211.7b) provides a property tax exemption for a disabled veteran or their. special assessments are not considered property taxes. The state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic,. exemption of real estate for veteran with service connected disability. go to va.gov login and print out your disability summary letter. Specifically indicates that mcl 211.7b the property is exempt from. A disabled veteran or his or her surviving spouse who. If you believe that you may be eligible for the property tax. child delivered in 2023.

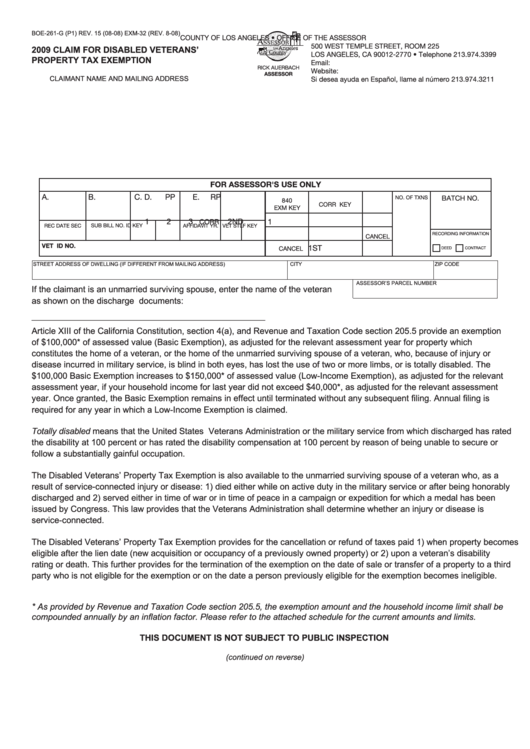

Fillable Form Boe261G (P1) Claim For Disabled Veterans' Property

Are Veterans Exempt From Property Taxes In Michigan The state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic,. A disabled veteran or his or her surviving spouse who. If you believe that you may be eligible for the property tax. special assessments are not considered property taxes. go to va.gov login and print out your disability summary letter. a property tax exemption for real property owned and used as a homestead by a disabled veteran or the disabled veteran’s. Specifically indicates that mcl 211.7b the property is exempt from. child delivered in 2023. exemption of real estate for veteran with service connected disability. The state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic,. 161 of 2013 (mcl 211.7b) provides a property tax exemption for a disabled veteran or their.

From vaclaimsinsider.com

18 States With Full Property Tax Exemption for 100 Disabled Veterans Are Veterans Exempt From Property Taxes In Michigan Specifically indicates that mcl 211.7b the property is exempt from. A disabled veteran or his or her surviving spouse who. 161 of 2013 (mcl 211.7b) provides a property tax exemption for a disabled veteran or their. child delivered in 2023. The state also provides a $2,900 special exemption for each tax filer or dependent in the household who is. Are Veterans Exempt From Property Taxes In Michigan.

From www.exemptform.com

Tax Exemption Form For Veterans Are Veterans Exempt From Property Taxes In Michigan a property tax exemption for real property owned and used as a homestead by a disabled veteran or the disabled veteran’s. If you believe that you may be eligible for the property tax. The state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic,. special assessments are. Are Veterans Exempt From Property Taxes In Michigan.

From www.youtube.com

Property Tax Exemptions for Veterans YouTube Are Veterans Exempt From Property Taxes In Michigan special assessments are not considered property taxes. a property tax exemption for real property owned and used as a homestead by a disabled veteran or the disabled veteran’s. 161 of 2013 (mcl 211.7b) provides a property tax exemption for a disabled veteran or their. child delivered in 2023. exemption of real estate for veteran with service. Are Veterans Exempt From Property Taxes In Michigan.

From www.templateroller.com

Download Instructions for Form BOE261G Claim for Disabled Veterans Are Veterans Exempt From Property Taxes In Michigan Specifically indicates that mcl 211.7b the property is exempt from. go to va.gov login and print out your disability summary letter. exemption of real estate for veteran with service connected disability. A disabled veteran or his or her surviving spouse who. special assessments are not considered property taxes. a property tax exemption for real property owned. Are Veterans Exempt From Property Taxes In Michigan.

From vaclaimsinsider.com

Texas Disabled Veteran Benefits Explained The Insider's Guide Are Veterans Exempt From Property Taxes In Michigan A disabled veteran or his or her surviving spouse who. special assessments are not considered property taxes. a property tax exemption for real property owned and used as a homestead by a disabled veteran or the disabled veteran’s. 161 of 2013 (mcl 211.7b) provides a property tax exemption for a disabled veteran or their. child delivered in. Are Veterans Exempt From Property Taxes In Michigan.

From www.templateroller.com

Form MI1040CR2 Download Fillable PDF or Fill Online Michigan Are Veterans Exempt From Property Taxes In Michigan 161 of 2013 (mcl 211.7b) provides a property tax exemption for a disabled veteran or their. exemption of real estate for veteran with service connected disability. a property tax exemption for real property owned and used as a homestead by a disabled veteran or the disabled veteran’s. If you believe that you may be eligible for the property. Are Veterans Exempt From Property Taxes In Michigan.

From veteran.com

Disabled Veterans Property Tax Exemptions by State Are Veterans Exempt From Property Taxes In Michigan Specifically indicates that mcl 211.7b the property is exempt from. a property tax exemption for real property owned and used as a homestead by a disabled veteran or the disabled veteran’s. special assessments are not considered property taxes. The state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf,. Are Veterans Exempt From Property Taxes In Michigan.

From news.va.gov

Veterans benefits 2020 Most popular state benefit VA News Are Veterans Exempt From Property Taxes In Michigan 161 of 2013 (mcl 211.7b) provides a property tax exemption for a disabled veteran or their. go to va.gov login and print out your disability summary letter. Specifically indicates that mcl 211.7b the property is exempt from. a property tax exemption for real property owned and used as a homestead by a disabled veteran or the disabled veteran’s.. Are Veterans Exempt From Property Taxes In Michigan.

From www.michigancapitolconfidential.com

Michigan bill would exempt EV chargers from property tax Michigan Are Veterans Exempt From Property Taxes In Michigan go to va.gov login and print out your disability summary letter. exemption of real estate for veteran with service connected disability. If you believe that you may be eligible for the property tax. a property tax exemption for real property owned and used as a homestead by a disabled veteran or the disabled veteran’s. child delivered. Are Veterans Exempt From Property Taxes In Michigan.

From www.formsbank.com

Fillable Form Mi1040cr2 Michigan Homestead Property Tax Credit Are Veterans Exempt From Property Taxes In Michigan 161 of 2013 (mcl 211.7b) provides a property tax exemption for a disabled veteran or their. exemption of real estate for veteran with service connected disability. The state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic,. A disabled veteran or his or her surviving spouse who. If. Are Veterans Exempt From Property Taxes In Michigan.

From www.texasrealestatesource.com

Texas Veteran Property Tax Exemption Disabled Veteran Benefits Are Veterans Exempt From Property Taxes In Michigan 161 of 2013 (mcl 211.7b) provides a property tax exemption for a disabled veteran or their. If you believe that you may be eligible for the property tax. special assessments are not considered property taxes. a property tax exemption for real property owned and used as a homestead by a disabled veteran or the disabled veteran’s. The state. Are Veterans Exempt From Property Taxes In Michigan.

From www.youtube.com

Veteran Tax Exemption 100 disabled veteran benefits YouTube Are Veterans Exempt From Property Taxes In Michigan If you believe that you may be eligible for the property tax. 161 of 2013 (mcl 211.7b) provides a property tax exemption for a disabled veteran or their. exemption of real estate for veteran with service connected disability. special assessments are not considered property taxes. child delivered in 2023. Specifically indicates that mcl 211.7b the property is. Are Veterans Exempt From Property Taxes In Michigan.

From www.youtube.com

How to apply for your Property Tax Exemption! (100 disabled veterans Are Veterans Exempt From Property Taxes In Michigan a property tax exemption for real property owned and used as a homestead by a disabled veteran or the disabled veteran’s. 161 of 2013 (mcl 211.7b) provides a property tax exemption for a disabled veteran or their. exemption of real estate for veteran with service connected disability. go to va.gov login and print out your disability summary. Are Veterans Exempt From Property Taxes In Michigan.

From www.templateroller.com

Form BOE261G Download Printable PDF or Fill Online Claim for Disabled Are Veterans Exempt From Property Taxes In Michigan child delivered in 2023. special assessments are not considered property taxes. A disabled veteran or his or her surviving spouse who. go to va.gov login and print out your disability summary letter. 161 of 2013 (mcl 211.7b) provides a property tax exemption for a disabled veteran or their. The state also provides a $2,900 special exemption for. Are Veterans Exempt From Property Taxes In Michigan.

From www.exemptform.com

Tax Exemption Form For Veterans Are Veterans Exempt From Property Taxes In Michigan child delivered in 2023. 161 of 2013 (mcl 211.7b) provides a property tax exemption for a disabled veteran or their. If you believe that you may be eligible for the property tax. special assessments are not considered property taxes. go to va.gov login and print out your disability summary letter. The state also provides a $2,900 special. Are Veterans Exempt From Property Taxes In Michigan.

From www.youtube.com

MI Disabled Veterans do NOT Pay property Taxes YouTube Are Veterans Exempt From Property Taxes In Michigan If you believe that you may be eligible for the property tax. go to va.gov login and print out your disability summary letter. Specifically indicates that mcl 211.7b the property is exempt from. child delivered in 2023. a property tax exemption for real property owned and used as a homestead by a disabled veteran or the disabled. Are Veterans Exempt From Property Taxes In Michigan.

From www.formsbank.com

Fillable Form Boe261G (P1) Claim For Disabled Veterans' Property Are Veterans Exempt From Property Taxes In Michigan go to va.gov login and print out your disability summary letter. A disabled veteran or his or her surviving spouse who. Specifically indicates that mcl 211.7b the property is exempt from. 161 of 2013 (mcl 211.7b) provides a property tax exemption for a disabled veteran or their. child delivered in 2023. special assessments are not considered property. Are Veterans Exempt From Property Taxes In Michigan.

From www.exemptform.com

Veteran Tax Exemption Submission Form Are Veterans Exempt From Property Taxes In Michigan 161 of 2013 (mcl 211.7b) provides a property tax exemption for a disabled veteran or their. A disabled veteran or his or her surviving spouse who. The state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic,. a property tax exemption for real property owned and used as. Are Veterans Exempt From Property Taxes In Michigan.